Payment Processing 101: The Easiest Way of Increasing MRR

Convincing someone to pay you money is hard.

There are thousands, if not tens of thousands, of companies, products, and consultants who will sell you something that claims to help you make more money.

Some of these products/methods might work, some only in certain scenarios, and some are snake oil. It's really hard to tell which is which without experience.

From my experience, hands down the easiest way to make more money as a business is to find the people who are already trying to pay you and make it easier for them.

For 99% of subscription companies, the place to start is getting better at payment processing.

A Quick Primer:

Payment processing is everything that happens after someone has entered their payment info on your checkout page and clicked submit.

A surprising number of companies lose 10%+ of their monthly revenue due to payment issues.

To understand how to improve your payment processing, it helps to orient yourself in this world. The major players are:

Cardholders: Gets a credit or debit card from a bank and uses it to pay for things. These are your customers.

Merchants: A business that takes card payments for stuff. This is you.

Merchant Banks: Handles merchant accounts and lets merchants put money from card payments into their accounts.

Payment Processors: Companies that process card transactions & connect merchants, banks, card networks, and others to make card payments work.

Issuing Banks: Places that give out cards to people.

Card Associations (Visa, Mastercard, Discover, American Express): In charge of card rules and rates, handle things between banks.

You can visualize the world like this:

Why This Matters: Fraud Models, Account Balances, Cards

Understanding the details of each step isn't critical, but a general picture helps you understand why the optimizations work so well.

Subscription businesses, by nature, do a lot of payment processing as they collect the value from customers incrementally over time.

Instead of $120 upfront, most subscription businesses will collect $10 monthly for 12 months.

While this has a lot of benefits, such as making products more affordable to consumers, raising conversion, etc., the big downside of this is that there is a 12x increase in the likelihood that something will go wrong and you will lose money.

Pitfall #1: False Positives in Risk Models

Because of the legal liability and amount of money flowing through the payments universe, each one of these steps will have an ML-based risk model that seeks to protect whoever is on the hook for that step of the transaction from fraud.

All models have a false positive rate, meaning they will flag something that is legitimate as fraud and block the transaction.

For the sake of argument, let's assume that there are five major steps in processing that each step uses a model that is 99.5% accurate at identifying fraud.

You might be thinking that a .05% false positive rate isn't so bad, but you have to remember that each of the five steps has a 0.5% error rate, so that would be:

Total False Positives = 1 - (1 - 0.005) (1 - 0.005) (1 - 0.005) (1 - 0.005) (1 - 0.005) = 0.024875 or ~2.48%

Losing almost 2.5% of your recurring revenue monthly would be very bad, especially if it can be avoided.

Pitfall #2: Lack of Balance on Cards

To complete a transaction, your processor must validate that your user has the month to cover the transaction.

Not that they are "generally good for it" or that they might have the money soon. They need to have the money right now.

When you consider the realities of personal finance, that people get paid at different times, their spending habits vary, and these balances will fluctuate.

Your user might get paid on the 15th, but you tried to charge them on the 11th, and the card didn't have enough money.

Unless you have an auto-retry set-up, your billing system might mark this user as "failed payment," and you'll lose them forever.

Pitfall #3: Expired Cards & Changing

The big irony about subscription businesses is that the better you are at extending the LTV of your customers, the more payment issues you'll encounter.

The longer you charge someone, the more you'll have to deal with expiring cards and changing numbers.

The average credit card in the US expires every 3-5 years. If you are selling mostly annual plans (which should be your goal), you might only get 2 charges for a customer before the number changes.

This is especially painful as annual plans are likely your best customers.

So What Should You Do With This Information?

Payments are a very deep rabbit hole to go down, and what you should be doing depends on where you are as a company.

As companies get larger, they throw more and more resources at collecting payments as it is effectively free money that's there for the taking.

What you should be doing depends on where you are as a company, but this is the normal trajectory of tactics and tooling.

Step 1: Collecting Money At All

To collect anything, you need to have a payment processor set up. For most US-based companies, that typically means Stripe.

It's a solid product and has a lot of out-of-the-box functionality that is either free or very low cost. Set it up, configure your plans, and start charging.

As of August 2023, they are releasing a set of revenue recovery features that you should enable:

Auto Retry Failed Payments - Stripe comes out of the box with an Auto Retry feature, which you can set manually to try again every 1, 3, 5, or 7 days. This is better than doing nothing and should be enabled for all accounts.

ML-Based Dunning - This is like Auto Retry's big brother, where Stripe's algorithm is trying to guess when a card will have a balance on it. Based on the last prices I saw, you'll pay another 0.3% per transaction, but this was well worth it for most companies I work with. Do the math yourself, but I guess it will also be for you. I would also set this as aggressively as possible within a 30-day window.

Update Payment Method Emails - When a card expires or fails, Stripe will email them asking them to update the card or risk losing access. I find it worth it to put a little effort into these emails and ensure you send enough of them right after the payment fails.

Step 2: A Second Processing Gateway

Certain payment gateways are more effective at successfully charging people in certain countries. Gateways that are good for users within the US will not perform as well in places like Asia, India, and vice versa.

If you ask a payment gateway whether they are strong in a certain country, they will always say yes. Don't believe them. Ask around for similar companies in your industry and ask the subscription management companies if you can see benchmark data. They are more impartial.

Your second gateway should cover users in the part of the world where your first gateway is terrible at charging cards.

For most US-based companies, starting with Stripe, PayPal is typically the next payment gateway added.

It's generally good where Stripe is weak. If you are based in India, and your first option was something like PayTM, maybe Adyen is your next move so you can charge users who are based in Europe more successfully.

I have also heard anecdotally that having a legal entity & bank accounts in the same country, you're trying to process cards in helps.

I have never seen this work firsthand, but you should ask your gateways if this is true before going through the work to set up entities and bank accounts.

Step 3: Subscription Management Platforms

Now that you have two gateways, this hopefully allows you to collect more money but also introduces new headaches.

You need to manage pricing packages in two locations, settings in two locations, customer data in two locations, and having a centralized view of your revenue will be harder.

This is why subscription management platforms exist, and products like Recurly, Chargbee, and Paddle start to make sense. They will let you set up everything in one place and have all gateways follow those settings.

How much do these cost?

A stupid amount of money, but they are probably worth it.

They allow you to use the same revenue recovery features that Stripe has and see the benefit across all gateways.

Alternatively, you can build this functionality yourself, which will allow you to customize exactly what happens. Still, you probably need at least two engineers to build & maintain this full-time, so you'll probably save money by buying this to start.

Step 4: Adding Additional Gateways & A/B Testing Impact

Now that you have multiple gateways set up, you can try to find out which countries it makes sense to install a 3rd, 4th, or 5th gateway and A/B test the impact.

Last I checked, the subscription management tools don't have A/B as an out-of-the-box feature, but I recommend testing the impact and being confident that you're making the right call.

When I was at Codecademy, we ran these tests and couldn't reach significance when we were charging around $50M per year. I would guess that you need to be doing between $50-$100M ARR for this to be worth it.

These tests were not cheap to set up and took a long time to run, so I would wait until a company is reasonably mature to test this tactic.

Step 5: The Fancy Stuff

Past this stage, companies start to get creative with any way to prevent transactions from failing.

They cut data partnerships with credit card providers to ensure they know the new card number you'll be issued after your last card expires.

AAA, the Road Side Assistance company in the US, left me three voicemails when I didn't update my credit card for a $ 99-a-year membership. They can likely afford this as most members will be around for ten years, so any effort to prevent accidental churn is worth it.

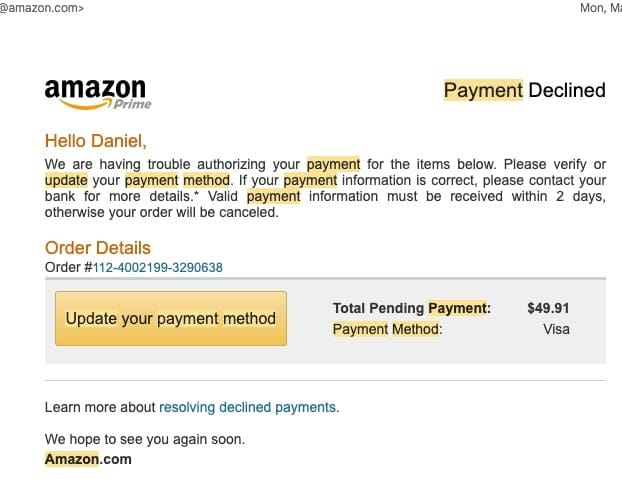

If you have ever added an invalid payment method on Amazon, you'll notice that you never get an error on the site.

Instead, you get an email a few minutes later asking you to update your payment method.

This is because:

Amazon is trying your payment method across multiple payment gateways to see if they can find one that will accept it

Users are probably more likely to update a payment method for something they think is already on the way than they are to try a second credit card after their initial transaction is declined.

They probably have 50 engineers working on this space full-time, but with their sales volume, it is worth it.

Good luck out there,

Dan